A Guide to Managing Debts for Single Moms

The good news about being a single mom is that there’s nobody to fight with when it comes to money matters. You have full control of your households’ decisions. On the downside, all the financial responsibilities are on you alone. You also need to work with a single income.

Raising a child is expensive. It is hard for a mother with a single income to manage debt, while providing for the needs of her family. It is easy to find yourself drowning in student loans, credit card balances, and other debts.

Debt Keeps on Growing

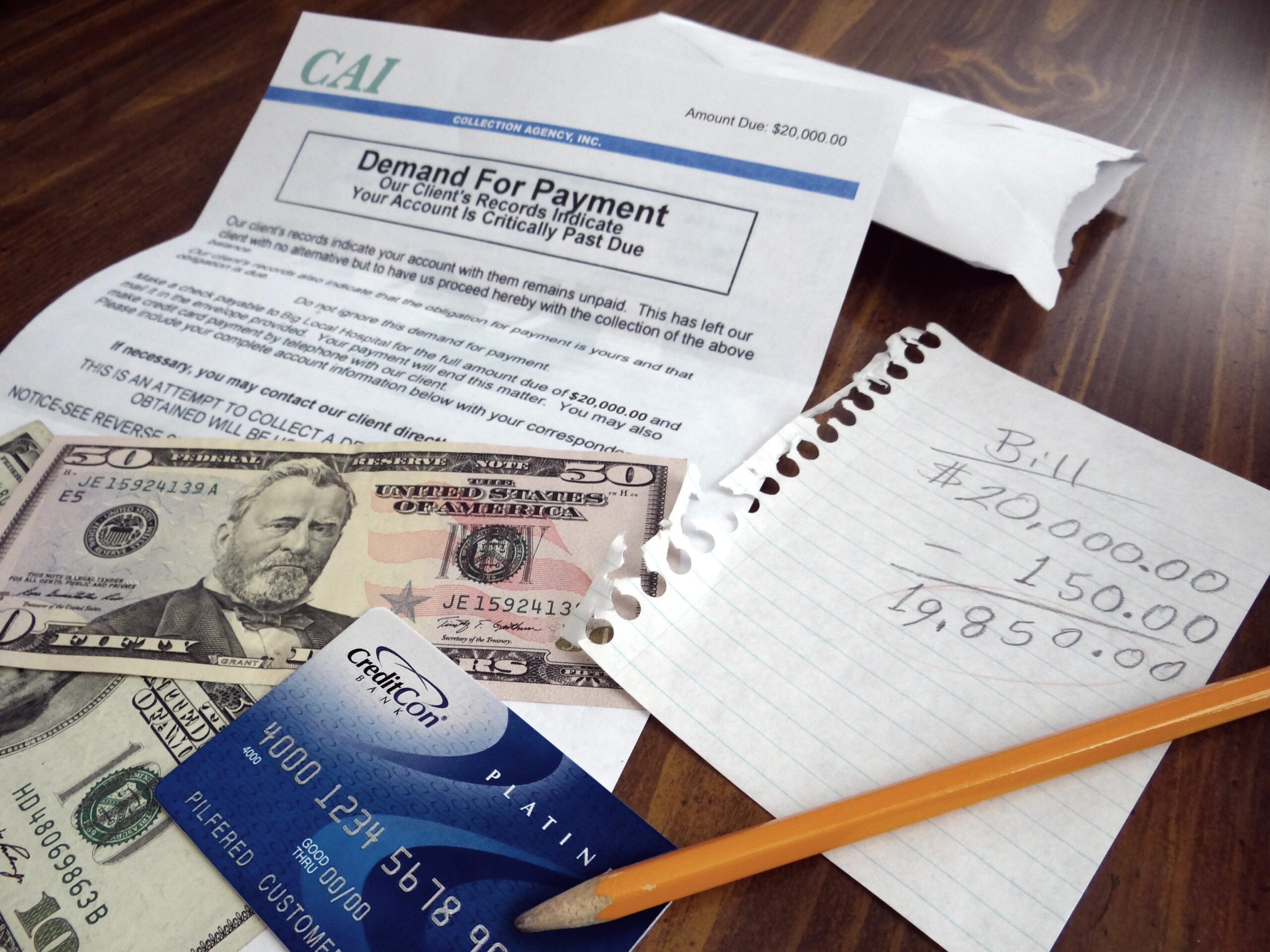

As a single mom, you might use your credit cards to pay the bills or get payday loans to make ends meet. As you start to default on loans, your constant callers will be collection agents. Even with a good paying job, it is hard to find a solution to this particular financial problem.

It is very stressful to struggle with your finances. Single moms face more stress as they try to balance their finances, parenting, and their careers at the same time. Without someone to lean on, overcoming debt is a very hard process.

The good news is that there are ways to lessen your financial burdens, even if you are a single mother. These tips can save money and help you reduce your debts so as to make them manageable.

Develop a Financial Plan

Most households don’t have a budget. Some mothers don’t even know how to make one. They just pay their bills and spend whatever they have until the next paycheck. They feel lucky if they have enough money to get through the month.

However, having no budget means overspending. There will be a deficit before the next paycheck and then, moms are forced to turn to credit cards to get by. The best way to prevent that from happening is to make a budget.

You should allocate amounts of your income to specific expenses and make sure that you don’t exceed that amount. For example, housing expenses should be 30 percent of your income. If you are paying more than that amount on your rent or mortgage, then it is one of the causes of your financial problems.

List all your expenses and your total income. Compare both numbers and find out if you are making enough to cover the basics. Without a budget, though, you don’t know how much you are actually spending, and you end up depending more on your credit cards or personal loans.

Make Timely Bill Payments

Being late paying your bills can affect your overall finances. Lenders often report late payments to credit bureaus, which results in lower credit scores. Lenders also charge expensive fees for late remittances. If you often pay after the due date, you should take some action that enables you to be on time for each payment.

Some lenders move the due date to a time when it might be difficult for you to make timely payments. Rent, car loans, and mortgages charge high late payment fees, so make sure that you pay them on time. You should avoid having to pay late fees because you can use that money on more important things.

You can raise some money to help you catch up with your bills by selling items you don’t use; a garage sale or even eBay can get you extra cash. You should not rely on your credit cards for a way to easily manage your finances.

Reduce Spending

The best way to save money is not to spend it on unnecessary things. If you are not making enough and yet, you eat out regularly or go to a movie every weekend, you should look at your expenditures and find ways to reduce excessive spending.

Some areas that you can also look at are your phone and cable bills. Dropping some services might give you a 10 to 20 percent savings on these bills. Look at recurring charges that slowly drain your savings.

You should also consider avoiding your favorite café every morning for a cup of coffee. Small daily expenses can add up to a large total every month.

Get Another Source of Income

You should consider getting another job to improve your cash flow. That way, you can pay off your debts sooner. However, there are instances in which it is impossible to get a second job because doing so will be too draining, both emotionally and physically. If that is the case, look for other ways to make money, such as starting a home business.

Pay Off Debt

The best way to manage debts is to get rid of them. Proper planning and budgeting can help single moms pay off personal loans, student loans, and other debts in no time.

Most people use the snowball method, which involves paying off the debt with the lowest remaining balance, while at the same time, repaying only the minimum on the rest. Once you have repaid the lowest, you move to the next one. The process continues until all the long term loans are paid.

You can also look at getting a low-interest loan to consolidate all the other loans. Transferring the balance to the loan with a lower interest would make all the loans more manageable.

Being a single mom is not an excuse to be drowning in debt. Follow the tips above. And you will enjoy financial independence in no time. Having no one to share your burdens should not stop you from achieving important financial goals for yourself and your children.